About Global Link Management - Our Commitment

Real estate plays a role as an asset held by people and companies and as a part of social infrastructure that supports their activities. We believe that our mission is to link real estate to the happiness of people around the world. We will work on global environmental, social, and economic issues as we pursue new possibilities in real estate.

Our mission is to realize a prosperous society through real estate, and we aim to be a leader in the real estate industry to achieve this goal.

Management Policy

We place importance on the following three points in our management policy and decision making.

- No. 1 (No. 1 in employee pride, No. 1 in customer excitement, and No. 1 in business scale)

- Ambition (speed in management execution, pursue business transformation, expand businesses as a one-stop provider of solutions)

- Co-creation (co-create business that benefits the environment, society, and GLM)

Business Features

GLM is a developer that as a one-stop shop provides services from land purchase to planning and development, sales, and management of condominiums with the main purpose of asset management, mainly in the Tokyo Metropolitan Area (Tokyo, Saitama, Chiba and Kanagawa)

Specializing in prime locations in the city center, along main railway lines, and areas with high long-term returns, we are developing timeless multi family buildings that pursue design and affluence as part of our Artessimo Series.

Artessimo Series

We are developing our own brand or properties called the Artessimo Series in an area with a high land price, close to stations, and close to the city center (3Cs).

What is Artessimo?

Artessimo is a coined word that GLM created based on modern Italian, combining ART [art] and issimo [premium])". The concept behind the brand is to provide modern and comfortable spaces.

Real Estate Solutions Business

We develop small condominiums (20 to 60㎡), which are mainly investment properties, and supply them to individual investors, businesses, real estate companies, private funds, private placement REITs, J-REITs, and institutional investors.

After the sale, we are contracted with the operation of condominium management associations and property management services from the condominium management association of the sold property. Property management has carried out by our subsidiary, G&G Community, since 2021.

Property Management Business

Contracted by the building owner, we perform various tasks related to real estate management.

Specifically, we provide master lease and sublease services as well as management agency services.

Growth Strategy

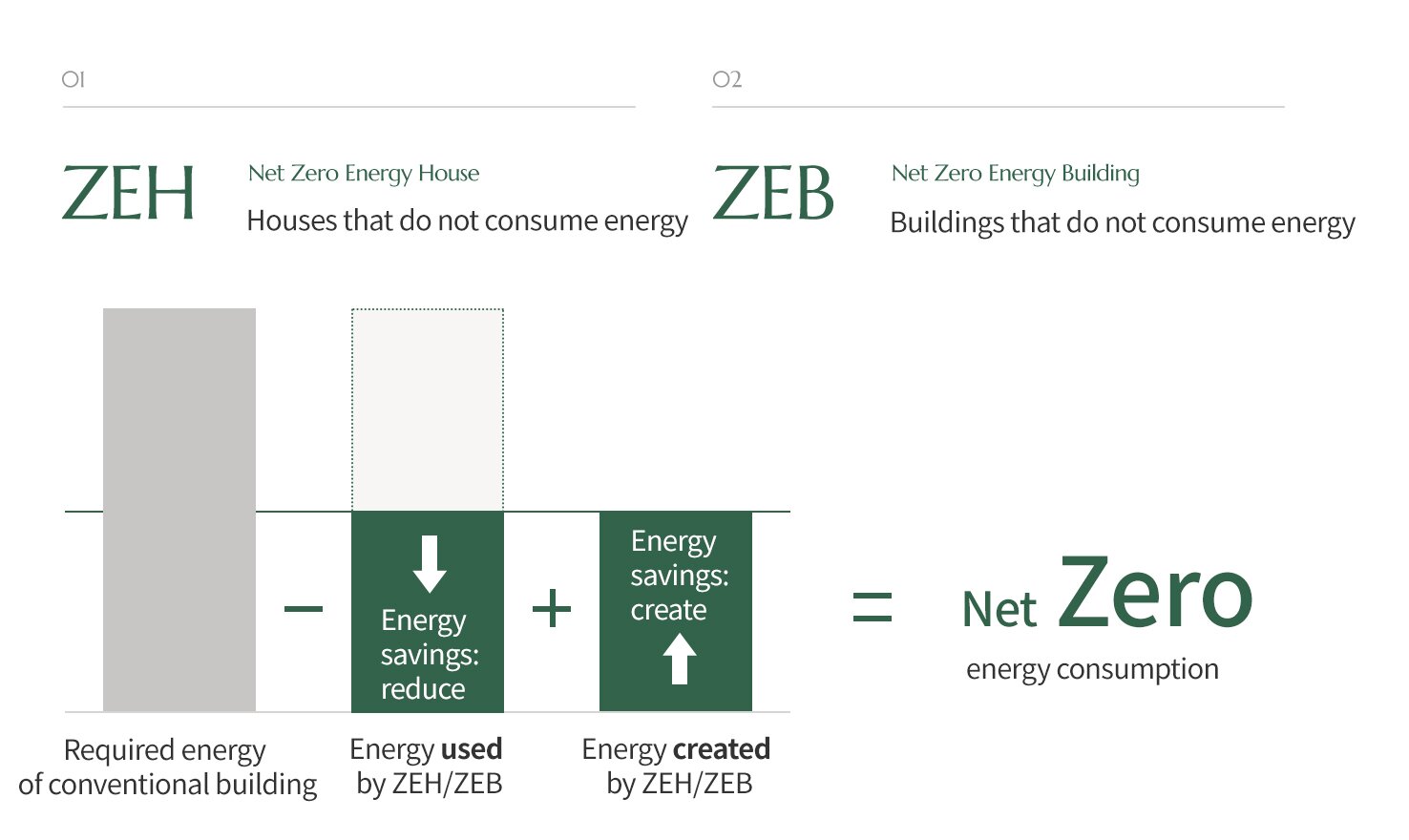

Initiatives for Environmentally Friendly Buildings: ZEH and ZEB

Contributing to Further Improvement of Asset Value through Environmental Certification in addition to Conventional 3Cs Properties

Currently, efforts toward decarbonization are also underway in the real estate industry.

ZEH/ZEB initiatives to achieve net zero energy consumption are the key to a decarbonized society.

The Japanese government also aims to meet these standards for newly built houses by 2030. Going forward, we will make it a standard specification that properties we develop will comply with the ZEH or ZEB or BELS4 or higher.

Sustainable Development Goals

The Sustainable Development Goals, or SDGs, were established in September 2015. GLM is also carrying out various activities to realize the SDGs.

Improving profit margins by improving sales efficiency: Strengthening sales of whole buildings and off-balance sheet development

Whole Building Sales

Unlike conventional unit sales, in which properties are sold one unit at a time, whole building sales refers to the sale of multiple units in the same building at once. In contrast to unit sales, which are sold after completion, it is possible to contract with institutional investors to sell an entire building at the pre-completion stage. In this manner, shifting from unit sales to whole building sales, so-called "bulk sales," leads to an increase in added value, in addition to improving sales efficiency.

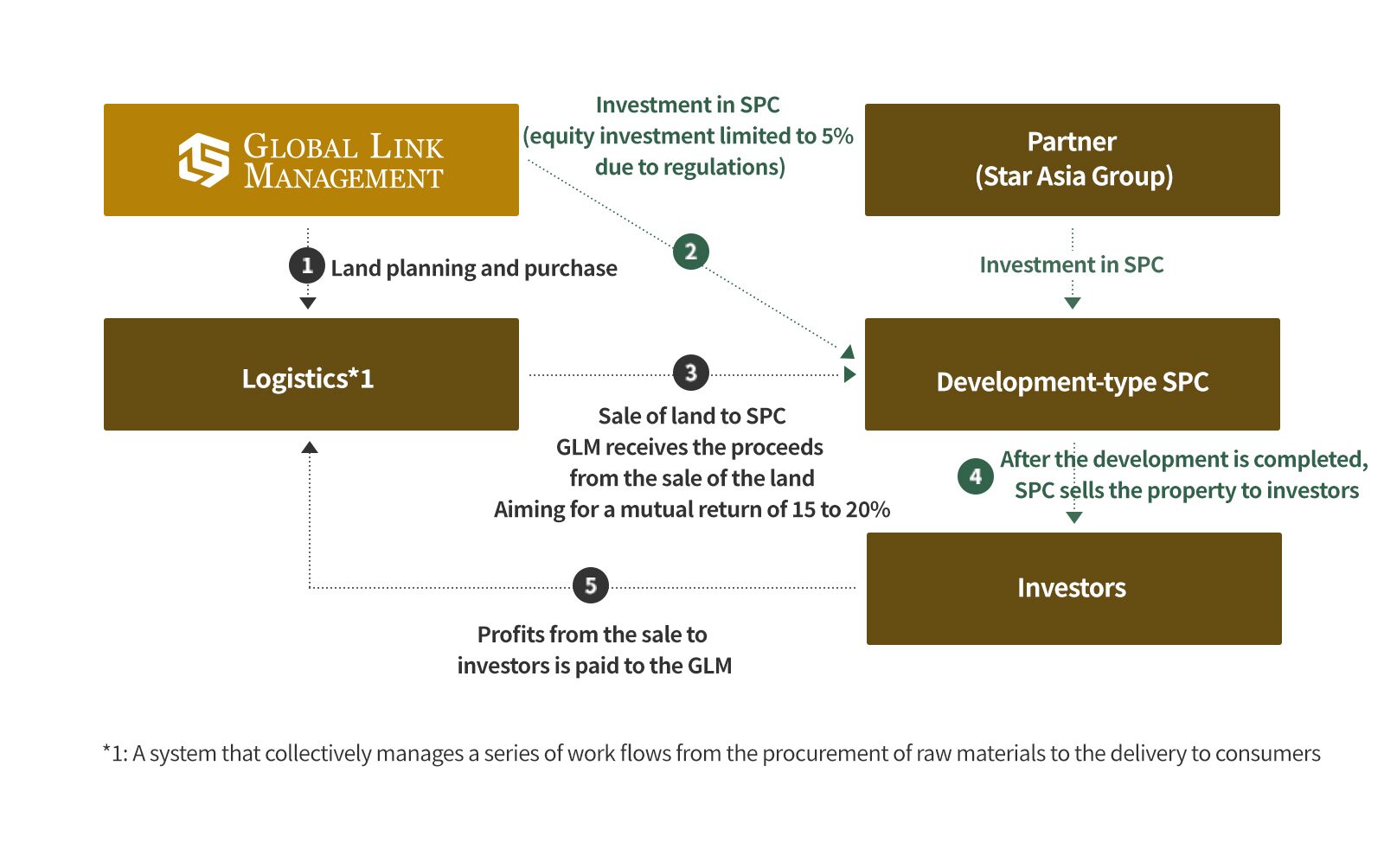

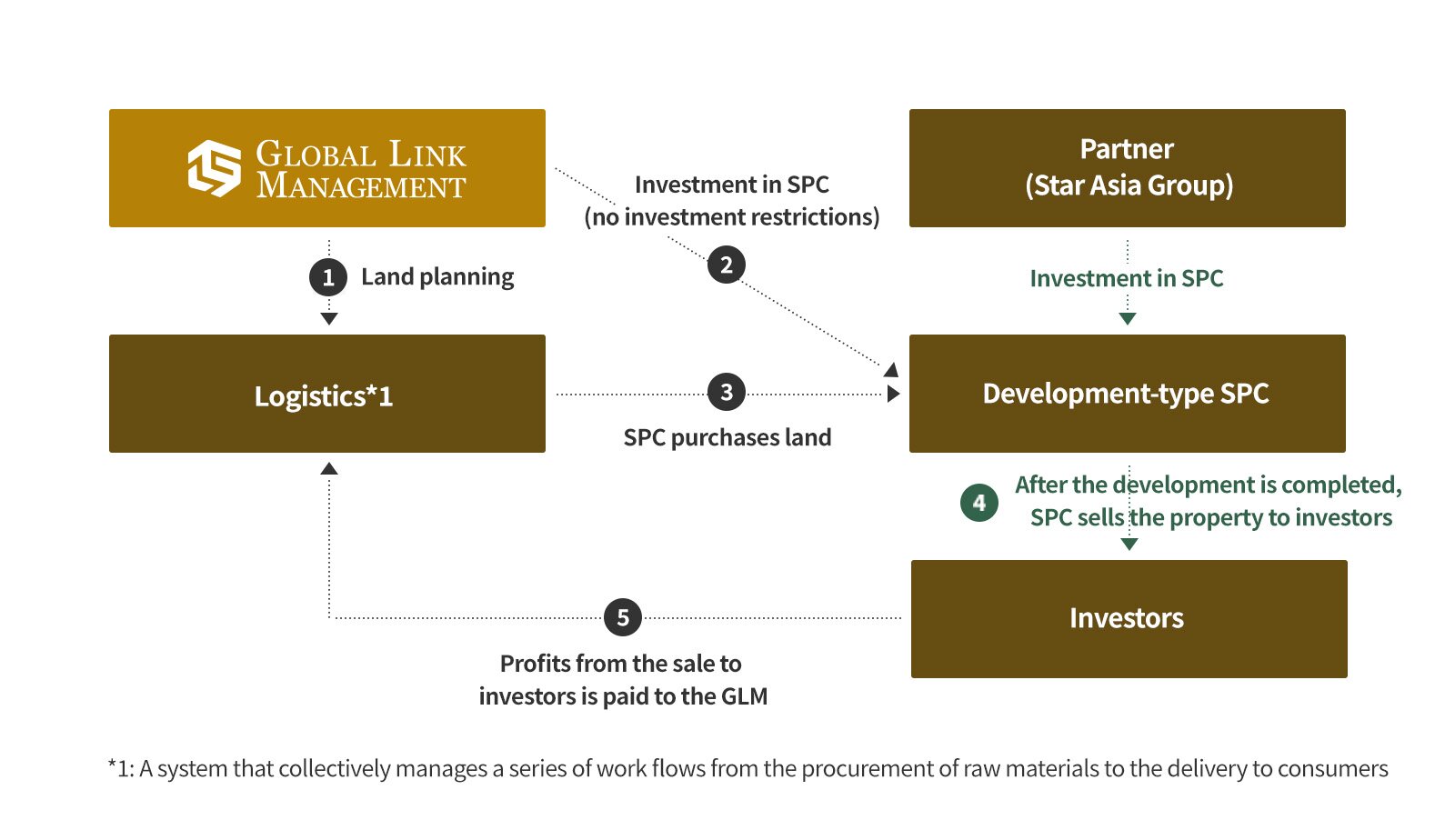

What is Off-Balance Sheet Dtructure?

There are two types of development: on-balance sheet development, where we develop properties on the company's balance sheet, and off-balance sheet structure, in which we plan and study developments but have a partner purchase and develop the land. In both cases, we sell the entire building after completion, but while we are subject to financial constraints in on-balance sheet structure, we are not subject to these same constraints in off-balance sheet structure. Off-balance sheet structure enables a greater volume of development that increases the speed of development and supply.

Establishing New Segments: Moving into the Non-Residential Domain

We will continue to develop logistics facilities amid rising demand following the COVID-19 pandemic.

The development of logistics facilities will be carried out in a risk-free manner through SPCs with partner companies.

We are targeting investments in SPCs to be 500 million yen in 2022, 1 billion yen in 2023, and 2 billion yen in 2024.

Non-residential projects are not included in the numerical plan up to the fiscal year ending December 31, 2024 due to the development period.

Low risk, middle return, 15 to 20% return at time of land sale

Expanding Business Coverage: Tokyo, Saitama, Chiba, Kanagawa Plus Kansai

We are looking to expand our business coverage from Tokyo, Saitama, Chiba and Kanagawa to include the Kansai area because of the growing area of population inflows area due to the pandemic.

We are also looking to expand nationwide by 2030.

Looking Toward the Future: GLM VISION 2030

In order to achieve our long-term vision, we have created a roadmap up to 2030.

GLM aims to become the top sustainable real estate development and management company using a combination of real estate, environment and DX.

We will respond to long-term changes through new businesses and virtual research. This will be achieved by transforming our current business structure, which is centered on residential properties, to a structure that balances economic value and environmental value through environmental measures and by developing our business in areas with high social value.

Dividend

With regard to shareholder returns, our basic policy is to achieve a dividend payout ratio of 30% while strengthening our corporate structure and growing our businesses. The dividend for the fiscal year ended December 31, 2023 is scheduled to be 100 yen per share.

✓If we do not make equity investments, we will use funds to pay dividends and other returns based on the basic policy.