*TCFD: Task Force on Climate-related Financial Disclosures

We have identified nine material issues to ensure that we achieve of our Long-Term Vision GLM VISION 2030 under our Corporate Philosophy (Mission) of realizing a prosperous society through real estate.

Among these, we recognize that addressing climate change is an important issue for sustainability management, and for this reason, we have identified two related material issues: planning, development, and operation of environmentally friendly real estate and contribution to climate change mitigation.

By addressing these two material issues, we will contribute to the mitigation of climate change, while also aiming for sustainable growth by viewing climate change as an opportunity and adapting to it.

In addition, we will promote the disclosure of information in accordance with the TCFD recommendations.

Governance

Governance Structure for Climate Change

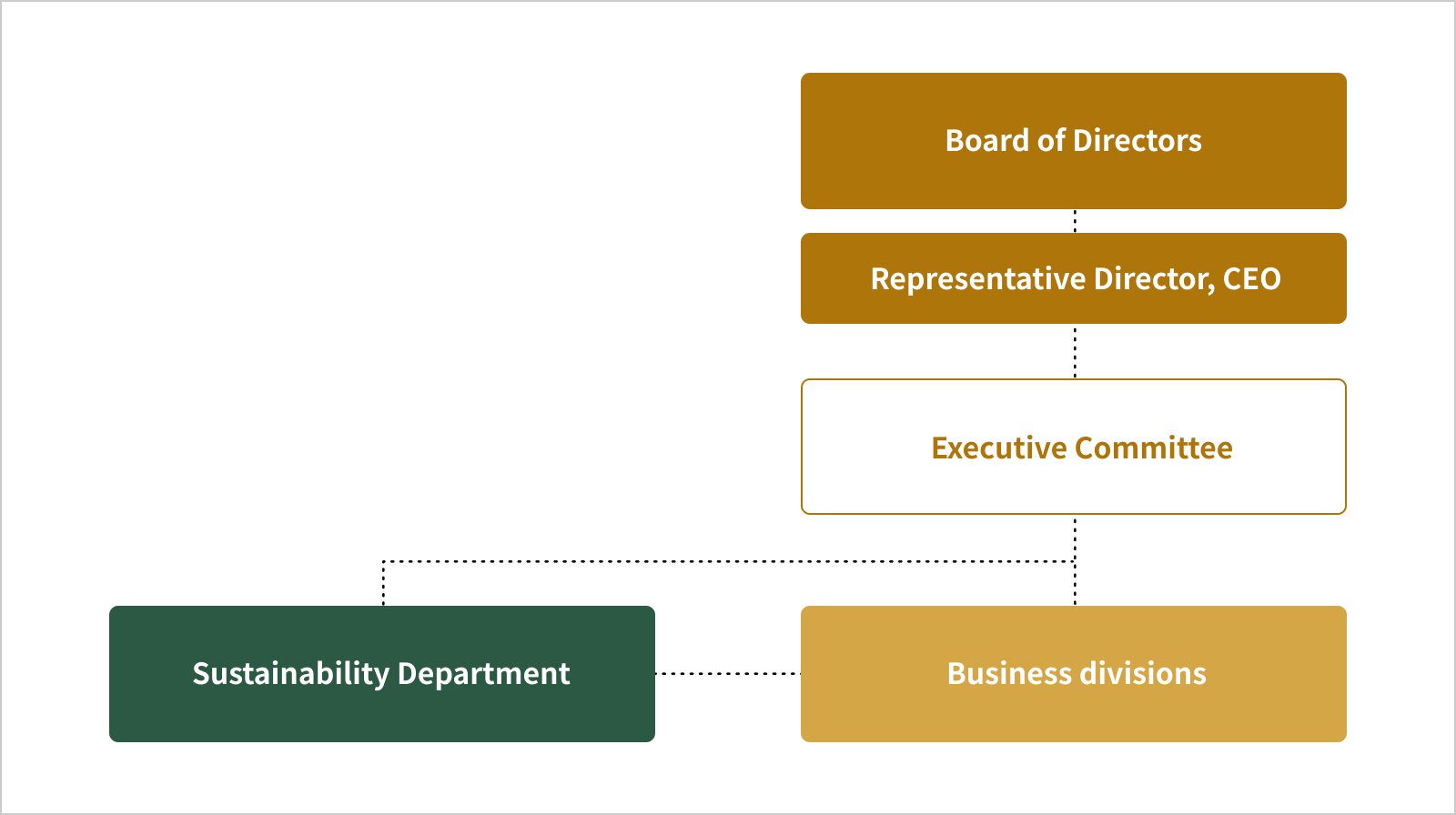

In January 2023, we established the ESG Team within the Corporate Planning Department, which reports directly to the CEO, in an effort to advance sustainability management.

In January 2024, we established the Sustainability Department to further strengthen our sustainability efforts and ensure the implementation of sustainability management through efforts to address each material issue (planning, development, and operation of environmentally friendly real estate and contribution to climate change mitigation).

In promoting these initiatives, the Board of Directors makes decisions and supervises sustainability initiatives discussed and deliberated by the Executive Committee and other meeting bodies.

Strategy

We conducted a scenario analysis on climate change in accordance with the following process.

Strategy (Scenario Selection)

For our scenario analysis, we adopted the 1.5°C to 2°C scenario and the 4°C scenario.

In selecting these scenarios, we refer to multiple scenarios from the IEA's World Energy Outlook 2023 and the IPCC's fifth and sixth assessment reports as sources.

| Overview of scenarios | Main scenarios (Transition risks) |

Main scenarios (Physical risks) |

|

|---|---|---|---|

| 1.5°C to 2°C scenario |

A scenario in which various policies and regulations are implemented to realize a decarbonized society, limiting the global temperature increase to less than 2°C above pre-industrial levels. Although transition risks may be higher, it is assumed that physical risks will be lower than in the 4°C scenario. |

1. IEA World Energy Outlook 2023: NZE2050 2. IEA World Energy Outlook 2023: APS |

1. IPCC: RCP2.6 (AR5) 2. IPCC: RCP1.9 (AR5) 3. IPCC: SSP1-1.9 (AR) |

| 4℃ scenario |

A scenario in which new decarbonization policies and regulations are not introduced, assuming that the goals of the Paris Agreement will be achieved. In this case, worldwide CO₂ emissions from energy are expected to increase continuously. Although transition risks are small, it is expected that physical risks such as natural disasters will increase as global warming progresses. |

IEA World Energy Outlook 2023:STEPS |

1. IPCC: RCP8.5 (AR5) 2. IPCC: SSP5-8.5 (AR6) |

Source: IPCC AR5/6 and IEA World Energy Outlook 2023

Strategy (Timeline)

We have organized the timeline for cases where the materialization of risks and opportunities will have an impact as follows.

(2023 set as the base year)

| Category | Period of impact | |

|---|---|---|

| Short-term | Timeline based on fiscal year | 1 year |

| Medium-term | Timeline based on Medium-Term Management Plan | 3 years |

| Long-term | Timeline based on GLM VISION 2030 | More than 3 years |

Strategy (Risk and Financial Impact)

Identification of short-, medium-, and long-term risks and opportunities and their financial impact

The following is an overview of the risks, opportunities, and financial impacts on the Company under the 1.5°C to 2°C scenario and the 4°C scenario.

■ Financial impact (impact on revenue)

- Impact expected to be positive:↗

- Assumed to have not impact: ー

- Impact expected to be negative:↘

| Item | Classification | Causes of risks and opportunities |

Details of risks and opportunities |

Adopted scenario | Period of impact | Financial impact | |||

|---|---|---|---|---|---|---|---|---|---|

| 1.5°C to 2°C scenario |

4℃ scenario | Short-term | Medium-term | Long-term | |||||

| Risk | New regulations risk | Introduction of carbon taxes | Increase in property construction costs due to soaring prices of building materials brought about by the introduction of carbon taxes | ◯ | ー | Medium-term/ Long-term |

ー | ↘ | ↘ |

| Risk | Real estate market risk | Growing demand for environmentally friendly real estate | Loss of sales opportunities due to delays in responding to the growing demand for environmentally friendly real estate in the real estate market | ◯ | ◯ | Medium-term/ Long-term |

ー | ↘ | ↘ |

| Risk | Reputation risk | Growing demand for climate-related disclosures, etc. | Decline in credibility and corporate value due to increased concerns of investors and other stakeholders due to insufficient or delayed responses to increasing requests for climate-related disclosures, etc. | ◯ | ◯ | Medium-term/ Long-term |

ー | ↘ | ↘ |

| Risk | Acute physical risks | Sudden extreme weather | Decline in the value of properties offered by the Company and an increase in countermeasure costs resulting from disasters caused by sudden extreme weather | ◯ | ◯ | Short-term/ Medium-term/ Long-term |

↘ | ↘ | ↘ |

| Risk | Chronic physical risks | Damage caused by medium- to long-term climate change | Decline in the value of properties offered by the Company and an increase in countermeasure costs resulting from damage caused by medium- to long-term climate change | ◯ | ◯ | Short-term/ Medium-term/ Long-term |

↘ | ↘ | ↘ |

| Opportunity | Products and services | Increasing demand for environmentally friendly real estate | Increase in sales opportunities in the investment real estate market due to increased demand for environmentally friendly real estate | ◯ | ◯ | Short-term/ Medium-term/ Long-term |

↗ | ↗ | ↗ |

| Opportunity | Capital markets | Expanded disclosure of climate-related information, etc. | Increased opportunities for returning funds from ESG investments and increased market capitalization by enhancing the disclosure of climate-related information, etc. | ◯ | ◯ | Short-term/ Medium-term/ Long-term |

↗ | ↗ | ↗ |

| Opportunity | Finance | Sustainable finance | Increased financing opportunities through sustainable finance brought about by the proactive development of environmentally friendly real estate and the reduction of GHG emissions | ◯ | ◯ | Short-term/ Medium-term/ Long-term |

↗ | ↗ | ↗ |

Risk Management Related to Climate Change

The Board of Directors approves risk management policy based on the need for risk management in new areas such as sustainability.

Our risk management is based on a framework that encompasses both risks that must be overcome in the execution of strategies ("strategic risks") and risks that impede business operations ("operational risks"). Climate change has been positioned as a "strategic risk."

We define climate change risk as the risk that the business environment will change beyond expectations due to the occurrence of physical events such as wind and flood damage caused by climate change and the transition to a low-carbon society such as changes in various systems. The Sustainability Department, which is in charge of climate change risk management, identifies and assesses risks on a quarterly basis and advances countermeasures.

In addition, we have established the Risk and Compliance Committee, which is comprised of executive officers, to deliberate and monitor important risks at the company-wide level, including climate change risks, on a quarterly basis.

Metrics and Targets

GLM’s Greenhouse Gas Emissions

We will calculate greenhouse gas emissions for Scope 1, Scope 2, and Scope 3,

set reduction targets for fiscal 2023 as the base year, and further accelerate our response to climate change and fulfill our responsibilities.

Summary of Main Data Points for 2023

| Target item | ||

|---|---|---|

| Scope 1 GHG emissions | 0 t-CO2e | |

| Scope 2 GHG emissions | Market based | 127 t-CO2e |

| Location based | 131 t-CO2e | |

| Scope 3 GHG emissions | Category 1 | 59,147 t-CO2e |

| Category 2 | 3,451 t-CO2e | |

| Category 3 | 40 t-CO2e | |

| Category 5 | 2 t-CO2e | |

| Category 6 | 30 t-CO2e | |

| Category 7 | 33 t-CO2e | |

| Category 11 | 54,785 t-CO2e | |

| Category 12 | 127 t-CO2e | |

| Category 13 | 82 t-CO2e | |

| Total of the above categories | 117,697 t-CO2e | |

-

We disclose the greenhouse gas emissions of consolidated subsidiaries in the current fiscal year on a non-consolidated basis because they are small (and difficult to calculate).

In the future, if the greenhouse gas emissions of consolidated subsidiaries affect the entire Group, we plan to disclose greenhouse gas emissions including those of consolidated subsidiaries. - Emissions are calculated based on the emission factor of electricity purchased according to electricity contracts.

- Emissions are calculated based on the average power generation emission factor at a specific location in a country or region.

Third Party Assurance

We have obtained third party assurance of our environmental from Lloyd's Register Quality Assurance Limited (LRQA).

LRQA Statement of Independence as a Third Party (PDF) (Japanese only)